How to Pay Yourself as an Independent Contractor

Are you on your journey to becoming an independent contractor? While this is a rewarding venture that offers flexibility and the opportunity to work on projects that truly excite you, one of the most crucial aspects of this journey is understanding how to pay yourself appropriately. Paying yourself as an independent contractor involves careful consideration of reasonable compensation, financial management, understanding industry standards and so much more. Are you ready to learn how to set your rates and manage your finances effectively? Let’s dive in!

Reasonable Compensation

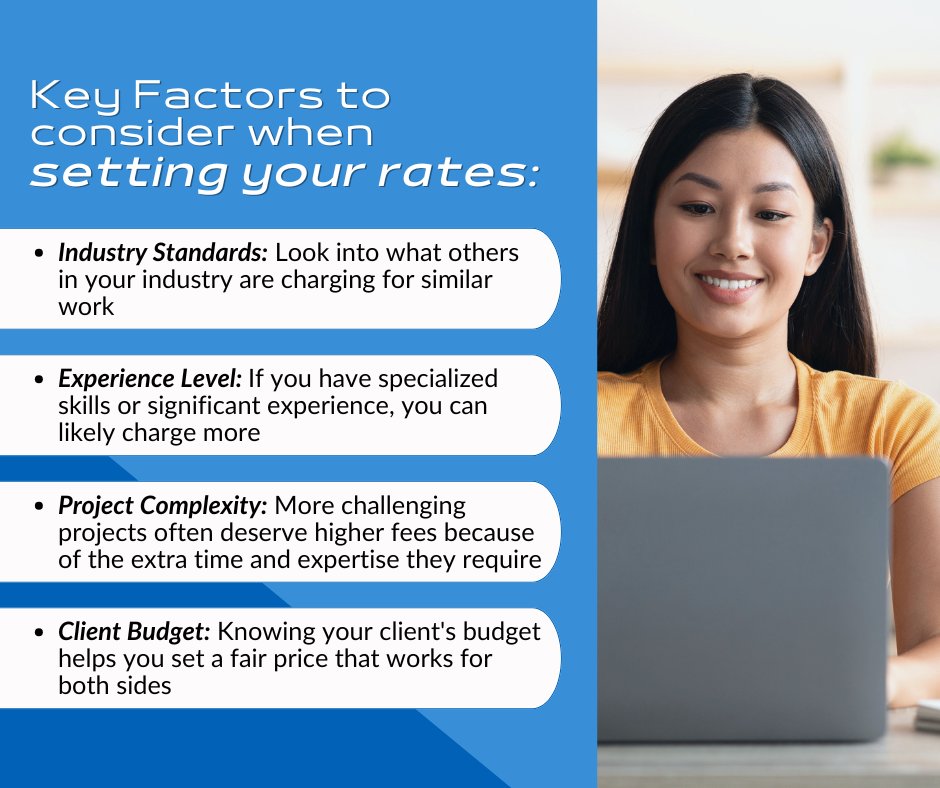

Before the how-to of paying yourself, it’s important to understand the concept of “reasonable compensation” in the context of independent contractors. This simply means paying yourself an amount that’s fair for the services you provide, based on your skills, experience, and what others in your field charge. Here are key factors to consider when setting your rates:

Setting Your Rates

- Hourly Rates: Charging by the hour can be beneficial if projects are unpredictable in scope or duration. It ensures you’re compensated for every hour worked.

- Project-Based Rates: This approach allows you to set a fixed fee for specific deliverables. It can be advantageous if you’re confident in estimating how much time a project will take.

Remember, you don’t need to pick just one way of billing. If hourly works for client A, but you have a good understanding of client B’s project and know a project-based rate is more appropriate, do that. Take charge of what’s best for your business! Another way to help set your fees (once learning your industry’s standards), is to create a rate card. A rate card outlines your fees for various services or project types, and this transparency will help your clients understand what they can expect when hiring you and will simplify future negotiations. As an independent contractor, you’re going to incur various expenses such as equipment costs, software subscriptions, taxes, and health insurance. When setting your rates and creating your rate card, ensure they cover these expenses while still providing yourself with reasonable compensation.

Managing Your Finances

Once you’ve determined how much to charge your clients, the next step is managing your earnings wisely. Here are some strategies and tips from the Pros to ensure your business runs smoothly:

- Establish a Salary Structure

Determine a regular salary structure based on your expected monthly income from contracting work. For example:

- Calculate average monthly earnings based on previous contracts.

- Decide on a fixed amount (your salary) that aligns with reasonable compensation.

- Pay yourself this amount regularly (weekly or monthly) regardless of fluctuations in contract income.

- Open a Separate Business Account

Keeping your personal and business finances separate by opening a dedicated business account simplifies accounting and helps you track income and expenses more efficiently. - Track Your Income and Expenses

Using accounting software or hiring a bookkeeper! It’s crucial to record all payments and expenses, and hiring a bookkeeper who will (most likely) already have a preferred software they use, to take that burden off your shoulders is the easiest way to gain a clear picture of your financial health. - Set Aside Money for Taxes

As an independent contractor, you’re responsible for paying self-employment taxes. A smart move is setting aside 25%–30% of each payment to ensure you’re prepared for tax season without any last-minute surprises. - Paying Yourself Regularly

Establishing a salary structure helps provide stability and ensures you’re fairly compensated. You can calculate your average monthly income and set a fixed salary to pay yourself regularly, regardless of income fluctuations. - Use Profit Distributions Wisely

If your business is structured as an LLC or corporation, consider making profit distributions at regular intervals. This strategy allows you to take home additional earnings after covering taxes and expenses. - Reinvest in Your Business

While it’s important to pay yourself, don’t forget to reinvest in your business. Allocating funds to improve skills, purchase equipment, or enhance service quality can lead to long-term growth and increased earnings.

By following these steps, you’ll not only manage your finances more effectively but also set your business up for long-term success! Remember that every contractor’s situation is unique—what works best may vary depending on individual circumstances—but following these guidelines will help ensure you’re getting fair compensation while allowing flexibility within this rewarding career path! If this all feels a little overwhelming, consider hiring a firm like CORE Financial who can help relieve that stressor of the unknown and take on your back-office duties. Partnering with CORE Financial will not only save you time, allowing you to focus more on your clients and growing the business, but it will also leave you feeling confident knowing that your business is set up for successful growth. Learn more on how we can help your business grow by getting in touch with us here.