Side Business, Smart Taxes: How to Reduce Taxable Income with a Side Business

Thinking about starting a side business—or already juggling one alongside your 9-to-5? Smart move. Not only can it bring in extra income, but it can also be a powerful tool to reduce your taxable income and create long-term financial stability.

We know how to help small business owners and side hustlers like you make the most of your money through smart, proactive financial strategies. Let’s dive into how a side business can be your not-so-secret weapon for tax season (and how our COREconnect membership plans can give you the tools and guidance you need to make it work).

What Is Taxable Income (and Why Should You Care)?

Taxable income is the amount the IRS uses to determine how much you owe in taxes. It includes wages, business income, investment returns, and more—minus any deductions or exemptions. The more you can reduce your taxable income legally and ethically, the less you pay in taxes. This is where your side business comes into play.

Why Start a Side Business for Tax Benefits?

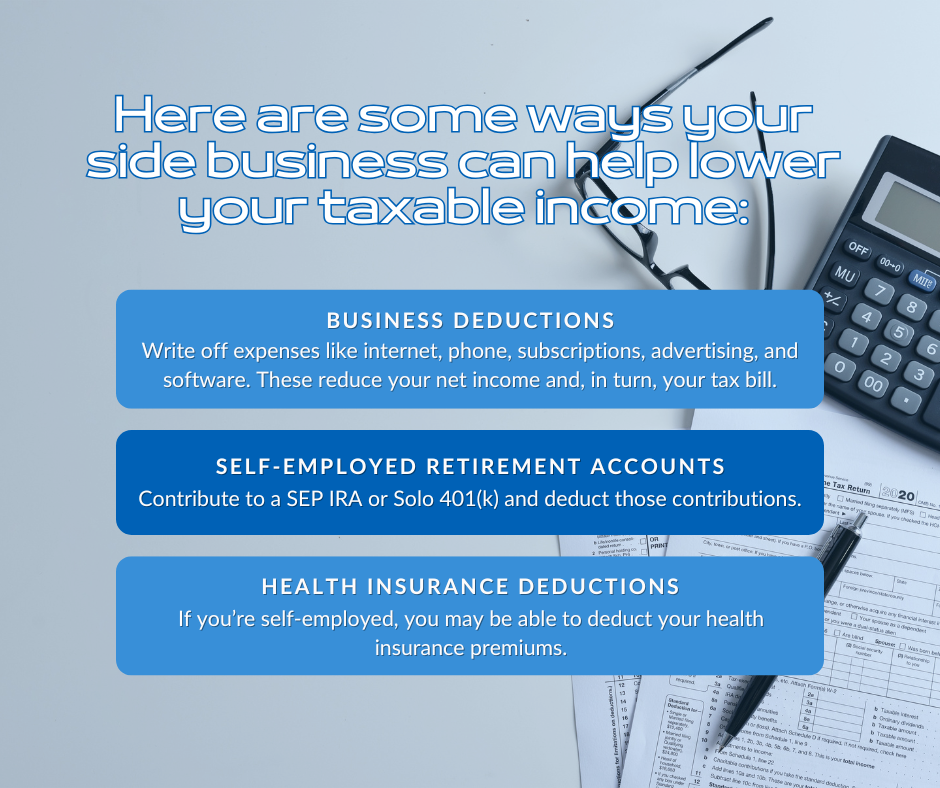

Running a side business doesn’t just put more money in your bank account, it opens the door to valuable tax deductions that employees don’t typically get.

Pro Tips for Effective Tax Planning

Ready to maximize those tax benefits? Here are a few tips from our Pros:

- Keep Excellent Records

Save receipts, log mileage, and document how each expense relates to your business. This isn’t just smart, it’s essential if you ever face an audit. - Separate Personal & Business Finances

Use a dedicated bank account and credit card for your business. It simplifies your bookkeeping and helps you track expenses accurately. - Choose the Right Business Structure

Sole proprietorship, LLC, or S-Corp? The structure you choose affects your taxes.

Common Deductible Expenses You Might Be Missing

To fully unlock the tax benefits of your side business, you need to know which expenses qualify. Some often-overlooked deductions include:

- Home Office Deduction: If you have a dedicated workspace at home used exclusively for your business, you can deduct a portion of your rent or mortgage, utilities, and more.

- Office Supplies & Equipment: Think printers, software, desks, or anything else needed to run your business.

- Travel & Meals: Business-related travel and meals may be deductible (be sure to keep records).

- Professional Services: Hiring a bookkeeper, accountant, or business consultant? Those costs are deductible too.

Not sure what qualifies? We’ve got plenty of downloadable resources to help! (Click the images to learn more)

COREconnect: Tiered Plans to Support Your Business Growth

We know the challenges of running a side business, especially when it comes to finances and tax strategy. That’s why we created COREconnect, our tiered membership program designed specifically for small business owners like you.

Here’s how COREconnect supports your journey:

- Foundations Tier: Perfect if you’re just getting started. Get essential resources and guided support to help you set up your business and stay compliant.

- Momentum Tier: For growing businesses, this level offers enhanced tools, workshops, and coaching to help you scale—and make smart financial decisions along the way.

- Impact Tier: You’re in full growth mode. This plan gives you advanced strategic support, ongoing financial insights, and exclusive access to our expert team.

Whether you’re figuring out deductions or building out a long-term financial plan, there’s a COREconnect plan that fits your business and budget. 👉 Explore your options here.

So Let’s Build Something Smart, Together!

Starting a side business can absolutely be part of a smart tax strategy, but it’s even more powerful when you have expert support behind you. With CORE Financial and COREconnect, you don’t have to navigate it all on your own.

Whether you’re freelancing, consulting, selling online, or launching a new service—there’s a plan (and a team) to help you make it financially sound and tax-efficient.

Ready to take your side hustle seriously—and save big come tax time?

💻 Learn more about COREconnect and find your plan today.