Cash vs. Accrual Accounting: Which Method is Right for Your Business?

When it comes to managing your business finances, understanding the difference between cash basis and accrual basis accounting is crucial. The primary distinction between the two methods boils down to timing—specifically, when you record revenue and expenses. So, how do you choose the right method for your business, and why? I’m going to tell you:

Cash Basis Accounting

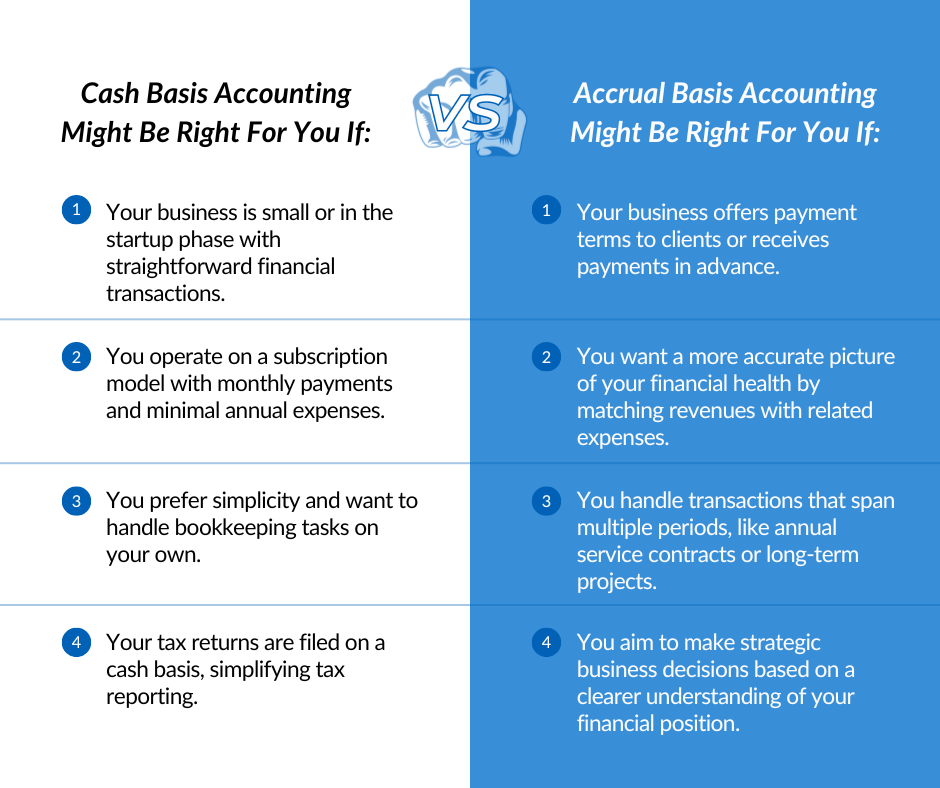

Cash basis accounting is straightforward and easy to understand. Under this method, you record revenue when you receive cash and expenses when you pay cash. Essentially, it’s all about money in, money out. This method is often favored by small businesses and startups because it simplifies the accounting process and minimizes the need for complex accounting entries.

One of the main advantages of cash basis accounting is its simplicity. There’s no need to worry about posting deferred revenue or prepaid expenses, which can be confusing for those not well-versed in accounting jargon. If your business is in its early stages and doesn’t have substantial revenue, cash basis accounting can be an excellent choice. Many companies can easily operate using the cash method, especially if they don’t have intricate financial transactions.

For instance, if your business operates on a subscription model where clients pay monthly based on their sign-up date, and you don’t have significant annual expenses, cash basis accounting might be the best fit. It allows you to manage data entry on your own, and when you eventually move to an accounting firm, it will save you money on bookkeeping services. Moreover, most tax returns are filed on a cash basis, which aligns with this method and simplifies tax compliance.

Accrual Basis Accounting

On the other hand, accrual basis accounting records revenue when it is earned and expenses when they are incurred, regardless of when the money is actually received or paid. This method provides a more accurate picture of your business’s financial health by matching revenues with the expenses incurred to generate them.

Accrual accounting is ideal if your business extends credit to customers or if you handle transactions that span multiple periods. For example, if you invoice a client in January for $12,000 for services to be provided throughout the year, but they don’t pay until February, accrual accounting allows you to recognize $1,000 of revenue each month (i.e., $12,000/12). This way, your January financials reflect the revenue you actually earned, even if you haven’t received the payment yet.

Similarly, consider large annual expenses like insurance. Under cash basis accounting, paying an annual insurance premium would result in the entire expense being recorded in the month you paid it. However, with accrual accounting, you can spread this expense over 12 months, providing a clearer picture of your monthly expenses and financial position.

Choosing the Right Method

So, why would you choose accrual accounting over cash basis accounting, or vice versa? The decision largely depends on your business model and financial complexity.

If you anticipate that your business will grow and become more complex over time, it’s often best to start with accrual accounting from the beginning. While cash basis accounting can be simpler in the short term, switching to accrual accounting later can be costly and disrupt consistent financial reporting. Starting with accrual accounting ensures you have a comprehensive view of your finances from day one, aiding in better strategic planning and decision-making.

Understanding the difference between cash basis and accrual basis accounting is vital for making informed decisions about your business’s financial management. While cash basis accounting offers simplicity and ease, accrual basis accounting provides a more accurate and comprehensive view of your financial health. Assess your business model, financial complexity, and long-term goals to choose the method that best suits your needs. By doing so, you’ll be well-equipped to manage your finances effectively and drive your business toward success.