What’s The Difference Between Accounting and Bookkeeping?

You’ve likely heard of accounting and bookkeeping, and as a business owner, you know you should be doing one or both for your business. But what exactly do they mean? Is one more beneficial for your health and wellness business than the other? Aren’t they the same thing?

While the terms are often used interchangeably and have some similarities, each serves a distinct purpose. Let’s explore these differences in detail so you can understand how each can contribute to your business’s success.

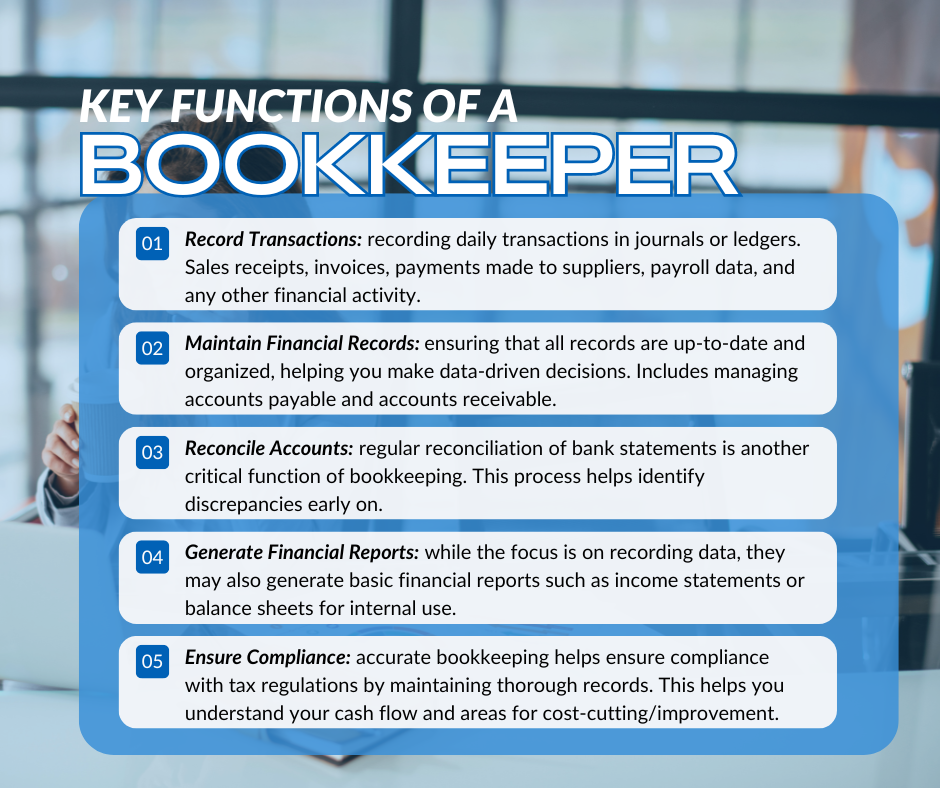

What is Bookkeeping?

Bookkeeping is the systematic recording of financial transactions, which then makes tax preparation more efficient. It involves intricately tracking all monetary activities within your business, ensuring that every transaction—a sale, purchase, payment, or receipt—is documented accurately, which makes tax preparation more efficient.. Bookkeepers are responsible for maintaining accurate records that clearly show your company’s financial status.

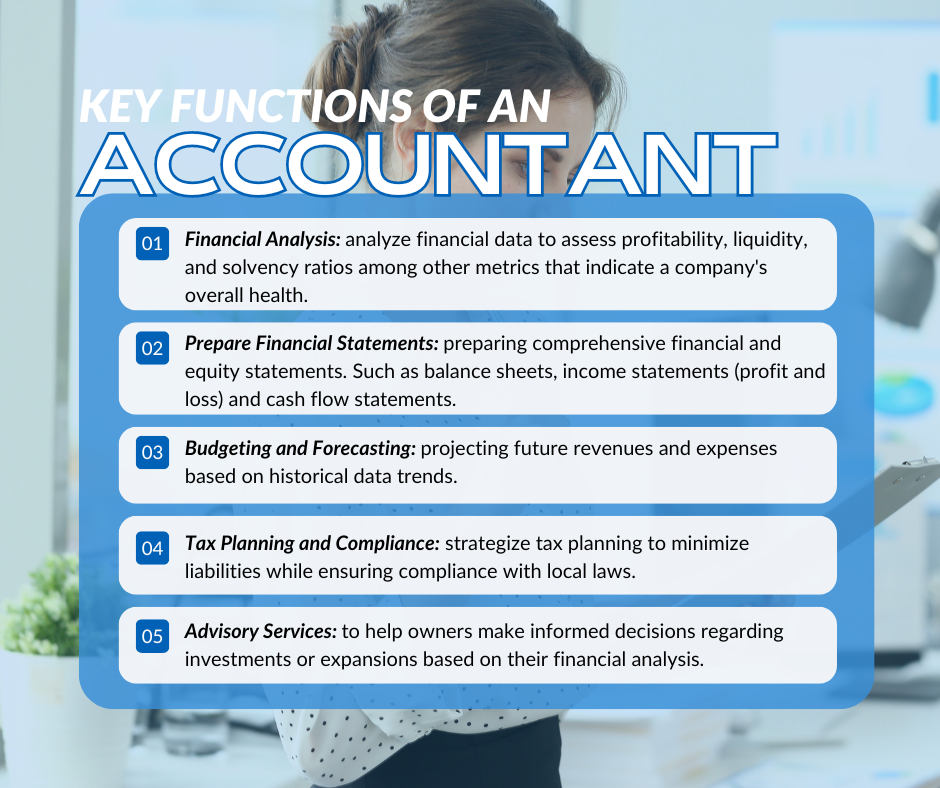

What is Accounting?

Accounting encompasses a broader scope than bookkeeping; it involves interpreting, analyzing, and summarizing financial data to provide insights into your company’s performance over time. Accountants take the information compiled by bookkeepers and transform it into meaningful reports to help guide your strategic decision-making.

Key Differences Between Accounting and Bookkeeping

While both functions are important to effective financial management within an organization, several key differences set them apart:

1. Focus of Work

- Bookkeeping focuses primarily on recording daily transactions accurately.

- Accounting focuses on interpreting those transactions to provide insights into the overall business performance.

2. Complexity

- Bookkeeping tasks tend to be more straightforward; they require attention to detail but do not necessarily require advanced knowledge.

- Accounting requires higher-level skills including analytical thinking as it deals with complex concepts like taxation laws or investment strategies.

3. Purpose

- The main purpose of bookkeeping is accuracy in record-keeping.

- The purpose of accounting extends beyond accuracy; it aims to provide strategic insights that inform business decisions.

4. Professional Qualifications

- Bookkeepers may not need formal qualifications beyond basic accounting principles.

- Accountants usually hold degrees in accounting or finance along with certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant).

Conclusion

Understanding the difference between accounting and bookkeeping can greatly benefit any business owner at any stage. While bookkeeping lays the groundwork by keeping accurate records of all transactions within an organization, accounting builds upon this foundation by analyzing those records for strategic decision-making purposes.

Both roles are vital; without effective bookkeeping practices in place—accurate record keeping—the accountant would lack reliable data necessary for insightful analysis! Recognizing their unique contribution will allow you to not only maintain compliance in your business but to also thrive financially through informed decision-making processes driven by solid data analysis from their accountants!

In summary:

- If you’re looking at day-to-day transaction management—think bookkeeping.

- If you’re aiming at a long-term strategy based on those transactions—think accounting.

By now I hope you clearly understand the distinctions between bookkeeping and accounting, and can now better navigate your journey as a business owner and make more informed financial decisions that drive growth.

Having a team that handles both bookkeeping and accounting under one roof, like CORE Financial, offers several advantages for a busy business owner. With streamlined communication, consistent record-keeping, and comprehensive financial oversight, CORE Financial ensures your health and wellness business’s financial records are accurate and up-to-date. Our approach not only saves you time and money but also provides tailored advice, improved tax preparation, and scalability as your health and wellness business grows.

Looking forward to get started with your health and wellness business. Get in Contact with Us Here!